- Shanghai Zhongshen International Trade Co., Ltd. - Two decades of trade agency expertise.

- Service Hotline: 139 1787 2118

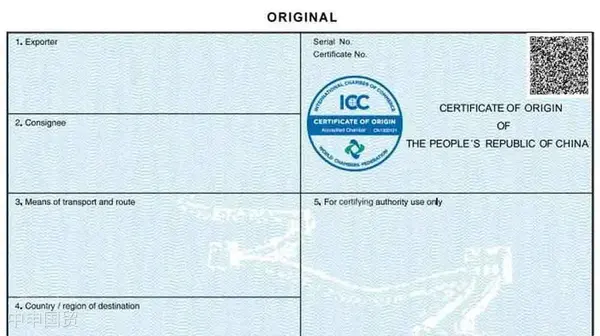

What is document consistency?

All documents provided by the exporter must strictly comply with the requirements issued by the importers issuing bankL/CConsistent and non-contradictory.

Key points of document consistency?

To maintain document consistency, banks will reasonably and prudently review all documents to ensure that the types, contents, quantities, and wording of the documents submitted by the recipient fully comply with document rules. Even if the goods are actually shipped, or the contents of the contract and confirmation do not match the terms of the letter of credit, the letter of credit takes precedence. In some cases, if the letter of credit is marked but the product is unsuitable, the bank has no way of knowing and bears no responsibility. Conversely, if the actual goods are correct but the documents appear inconsistent with the letter of credit, the issuing bank will be responsible, and the applicant can refuse payment accordingly.

How to effectively achieve document consistency?

Payment by letter of credit is very common in international trade. Therefore, Chinese enterprises must strictly adhere to the principle of document consistency in export business. After receiving the letter of credit from the foreign buyer, they should carefully study the letter of credit to determine whether its terms are consistent with the contract, whether there are hidden clauses, and whether the seller has the capability to comply.

If any issues are found, the buyer should be promptly notified to correct the credit, and one should not hope to be an exception where nothing happens. If no issues are found, the documents must be prepared carefully according to the letter of credit requirements, ensuring they match closely to prevent adverse situations, nip problems in the bud, and effectively protect ones rights.

Related Recommendations

? 2025. All Rights Reserved. Shanghai ICP No. 2023007705-2  PSB Record: Shanghai No.31011502009912

PSB Record: Shanghai No.31011502009912