- Shanghai Zhongshen International Trade Co., Ltd. - Two decades of trade agency expertise.

- Service Hotline: 139 1787 2118

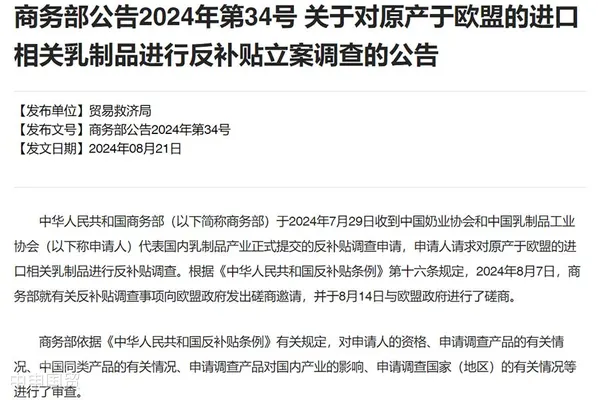

On August 21, 2024, Chinas Ministry of Commerce issued an announcement initiating anti-subsidy investigation on certain dairy products originating from the EU. This investigation was launched upon application by domestic dairy industry, which claims that relevant EU dairy products benefit from subsidies by EU and member state governments, creating price advantages in Chinese market and causing unfair competition pressure on domestic dairy industry.

The subsidy investigation period covers April 1, 2023 to March 31, 2024, while industry injury investigation period spans January 1, 2020 to March 31, 2024. The announcement specifies that investigated dairy products include fresh cheese (including whey cheese) and curd, processed cheese (such as blue cheese and veined cheese produced with Penicillium roqueforti), other cheeses not elsewhere specified, as well as milk and cream neither concentrated nor containing added sugar or other sweetening matter (containing over 10% fat by weight).

The director of MOFCOMs Trade Remedy and Investigation Bureau stated during press Q&A that this investigation was initiated upon formal application by domestic dairy industry. After review confirming the application meets Chinas relevant laws and WTO rules filing requirements, the decision was made to launch investigation. The investigating authority will follow legal procedures to fully protect all parties rights and make objective, fair rulings based on investigation results.

From the application content, domestic enterprises argue that relevant EU dairy imports benefit from subsidies, resulting in significantly lower prices in Chinese market compared to domestic counterparts. Data shows weighted average import prices of investigated dairy products are 30% to 50% lower than domestic products weighted average sales prices, substantially impacting domestic industrys profitability and market competitiveness. Particularly in recent years, substantial growth in EU dairy imports has intensified domestic market pressure.

Customs data indicates that from 2020 to 2023, investigated dairy imports cumulatively increased by 25.8%, with cream imports growing 26.6% in 2023 versus 2020, while cheese imports rose 23.5%. This import volume growth combined with price advantages has placed tremendous operational pressure on domestic dairy producers, with some enterprises operating rates declining to 10-50% and profitability significantly decreasing or turning to losses.

Regarding import sources, data shows Chinas cheese and cream imports mainly come from New Zealand and EU. In first half of 2024, China imported 88,400 tons of cheese (59.5% from New Zealand, 18.7% from EU) and 70,400 tons of cream products (85.6% from New Zealand, 12.1% from EU). These figures reflect EUs notable market share in Chinas dairy imports, with EU products price competitiveness exerting significant influence on domestic market.

Some relevant food enterprise executives stated that if investigation ultimately confirms subsidy issues with these EU dairy products, China may impose countervailing duties to increase their import costs. However, they believe the impact on domestic downstream market may be limited, as market demand persists and consumer demand for high-quality dairy products wont significantly decrease due to price adjustments.

Original Announcement:Ministry of Commerce Announcement No. 34 of 2024 on Initiating Countervailing Investigation into Imported Dairy Products Originating from the EU

Related Recommendations

? 2025. All Rights Reserved. Shanghai ICP No. 2023007705-2  PSB Record: Shanghai No.31011502009912

PSB Record: Shanghai No.31011502009912