- Shanghai Zhongshen International Trade Co., Ltd. - Two decades of trade agency expertise.

- Service Hotline: 139 1787 2118

This article details the customs classification, regulatory requirements of motorcycles, as well as the import certification requirements of some countries and regions. It provides customs classification and tax refund rates, introduces export inspection and quarantine requirements, and takes Thailand and the Philippines as examples to analyze in detail the main technical regulations, certification processes, and technical document requirements for motorcycle import certification.

I. Customs Classification and Regulatory Requirements

Motorcycles should be classified under the tariff item No. 8711, while motorcycle parts and accessories should be classified under the tariff item No. 8714.1000.

The tax rebate rate for motorcycles is 13%.

The regulatory document codes are 4 (Export License) and A (Inspection and Quarantine).

II. Export Inspection and Quarantine Requirements

Motorcycles are not products subject to legal inspection as determined by the General Administration of Customs. Their inspection and quarantine are carried out on a sampling basis, that is, only when they are selected during the customs inspection and quarantine process. However, relevant enterprises still need to pay attention to the laws, regulations, contracts and other requirements of the importing country (region) regarding the market access of motorcycle products.

Export enterprises should actively adopt the pre - declaration method to truthfully declare and inform relevant risk issues to avoid problems such as smuggling and under - reporting of dangerous goods (such as batteries, electrolytes, etc.) during customs inspection practices.

III. Import Certification Requirements for Motorcycles in Some Countries/Regions

Taking Thailands import certification requirements for motorcycles:

Laws and Regulations:Thailand is a contracting member of WP29s 1958 Agreement, with a relatively low adoption rate of ECE regulations. Among ECE regulations, Thailand has adopted 17, with motorcycle-related regulations shown in the figure below.

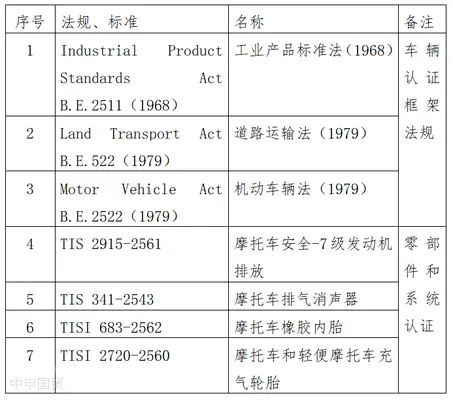

In addition, the laws and regulations on motorcycle control formulated by Thailand mainly include the vehicle certification framework regulations and the regulations for the certification of parts and systems. At the same time, TISI has also formulated the standards required for mandatory certification of motorcycles.

Certification Process:

1 Product Evaluation: TISI evaluates products based on Thai Industrial Standards (TIS) and special requirements for product certification. One of the following three methods can be used: sampling and testing by a designated laboratory, sampling and testing by enterprise personnel in the enterprise, or inspection of test reports.

2 Enterprise Inspection before Certification Issuance: For imported products, there is no need to inspect the enterprise. Only a document review of the quality control process is required.

3 Supervision and Review after Certification Issuance: In order to ensure that the certified products continue to meet the corresponding standards and that the enterprise still has the ability to maintain the quality of the certified products, the supervision and review system includes routine supervision and review, which can be carried out through supervision of the quality control system and/or supervision of the quality of the certified products.

Certification Mark:The TISI certification mark for motorcycles is shown in the figure below.

Technical Documents to be Provided:The technical documents to be provided include factory information (such as company business license, contact information, organizational structure diagram, quality manual, etc.), product information (such as product parameters, pictures, technical drawings, product catalog, product instruction manual, brochure, etc.), certification certificates and test reports of main components (such as test equipment list, production equipment list, importer documents, etc.).

Taking the Philippines import certification requirements for motorcycles

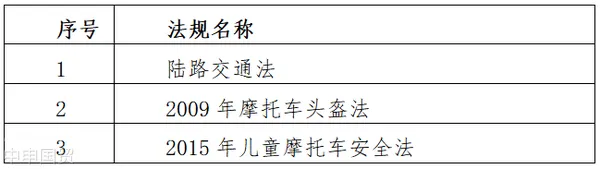

Laws and Regulations:The laws, regulations related to motorcycles in the Philippines and its adoption of ECE regulations are shown in the figure below.

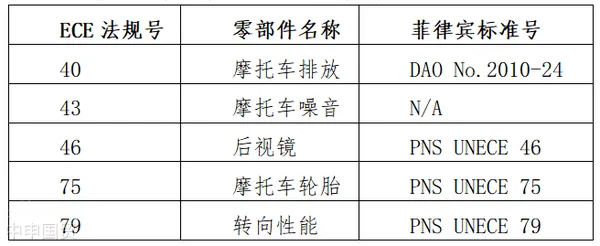

In addition, BPS has established a mandatory certification product system. Some motorcycle parts must obtain BPS certification or ICC import inspection before they can be cleared for customs and sold.

Certification Process:

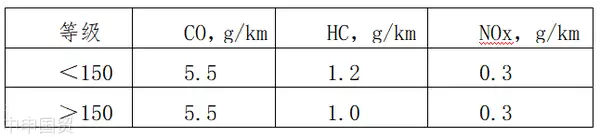

1 CoC Certification: The CoC application should be submitted to EMB by the motor vehicle manufacturer, assembler, importer or their duly authorized representative. A complete and detailed description of the motor vehicle and engine, a description of the emission control system installed in the motor vehicle, details of the fuel supply system, and the test results of the DOTC/LTO vehicle type approval system need to be provided. At the same time, it needs to comply with the motorcycle emission limits.

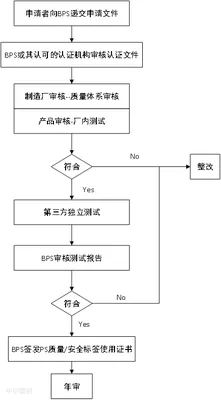

2.2 Motorcycle AccessoriesBPS Certification: The certification process includes submitting technical documents, and the review work is carried out by BPS, DTI regional/provincial offices, or auditors of recognized national standards bureau certification bodies. After the review, if BPS finds that the applicant complies with the regulations, the director or agent of the standards bureau will approve the applicants application and issue a certificate. The certificate is valid for 3 years, and an annual review is carried out at least once a year.

3 ICC Certification: Before importing products that require mandatory BPS product certification, the importer should submit an ICC certification application online to the National Single Window System (NPW), and submit a copy, Quality Management System (QMS) certification and/or other QMS documents related to the product manufacturer, as well as relevant documents to BPS or the nearest DTI regional office.

Technical Documents:BPS form PS/SF01 in triplicate, the applicant complies with the terms and regulations of PS certificate usage, the application documents should be signed by the applicant or their authorized management representative, the application and final certificate must display applicable standards, factory address, and product trademarks. Different production standards or factory addresses require separate applications, quality manual.

Certification Mark:The PS certification mark is shown in the figure below. At the same time, the PS certification mark should also meet the following requirements.

ICC Certification Label (Left: Label adopted from 2018 - 2020; Right: Label adopted since 2021).

Import Procedures:All incoming goods enter the Philippines through two channels, formal or informal import, except for goods imported duty - free by embassies and consulates in the Philippines and foreign government agencies authorized by the relevant Philippine departments. The import declarant must declare to the customs within 30 days from the date of completion of unloading. The customs declaration period cannot be extended. Goods not declared to the customs are deemed to be abandoned, and the goods will be confiscated ipso facto.

Related Recommendations

Category case

Contact Us

Email: service@sh-zhongshen.com

Related Recommendations

Contact via WeChat

? 2025. All Rights Reserved. Shanghai ICP No. 2023007705-2  PSB Record: Shanghai No.31011502009912

PSB Record: Shanghai No.31011502009912